Srinagar

In order to encourage large investment, incentivize the newly established units and the units undergoing substantial expansion, the State Administrative Council (SAC) on Tuesday evening under the chairmanship of Governor, Satya Pal Malik accorded sanction to the notification of the scheme namely the ‘Jammu and Kashmir Reimbursement of State Taxes for encouraging large investments for industrial development’.

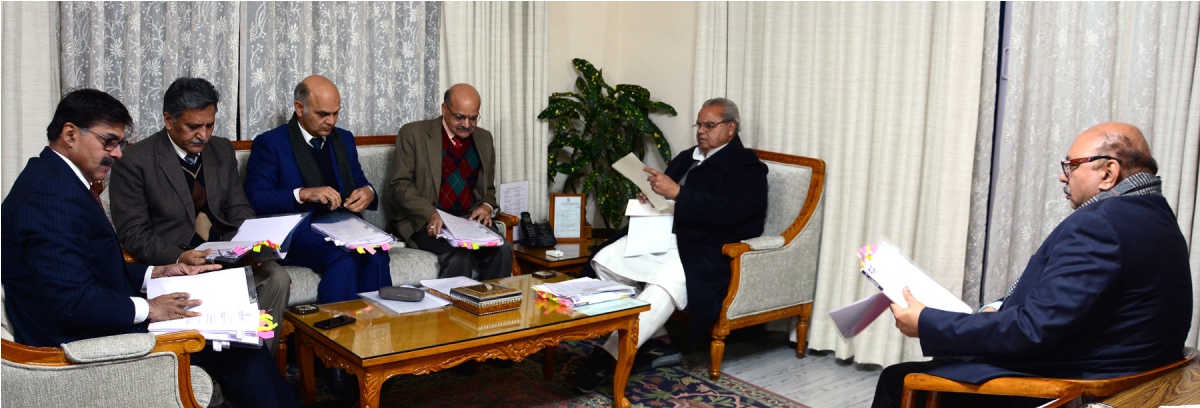

GOVERNOR-SAC MEETING

The spokesman said that state has in the Industrial Policy-2016 fixed a target of attracting an investment of Rs 2000 Crore per annum in the industrial sector including services. The State Government has already incentivized the existing industrial units by giving them reimbursements of taxes after adjustment of Input Tax Credit under various schemes announced by Government of India from time to time in the shape of SROs viz SRO 519, SRO 521, SRO 63, SRO 431 etc.

In order to attract investment of Rs 2000 Crore per annum, as envisaged in the Industrial Policy 2016, the SAC approved the ‘Jammu & Kashmir Reimbursement of State Taxes’ scheme for providing reimbursement of State Taxes to the Industrial Units undergoing substantial expansion involving investment of Rs 50 crore or more, either on substantial expansion or new setup. The industrial unit shall make a claim of only the cash paid in the shape of SGST after adjusting the input tax credit. The industrial unit shall exclusively be involved in the process of manufacturing activities. The industrial unit shall be eligible for reimbursement of the tax on the supplies resulting due to substantial expansion only in case of units undergoing substantial expansion.

The newly established industrial units shall be eligible for full reimbursement of the SGST paid in cash after adjusting input tax credit. The scheme shall be applicable only for intrastate supplies made by the industrial units.

The scheme shall not be applicable to the industrial units mentioned in the negative list to the Government of India notification dated 1st January 2019, covering units manufacturing Tobacco, Pan Masala, Plastic Carry Bags, power generating units above 10 MW, coke, fly ash, Cement, Steel Rolling Mills, Gold and Gold Dore, goods produced by Petroleum or Gas refineries, industrial units not complying with environment standards or not having applicable environment clearance from the Competent Authority and low value addition activities like preservation during storage, cleaning, operations, packing, re-packing or re-labelling, sorting , alteration of retail sale price etc.

The move will attract large investment in J&K, which in turn will expand employment opportunities for skilled youth, income generation and overall economic development in the state.

from Kashmir Life http://bit.ly/2CRN7BE

via IFTTThttps://kashmirlife.net

No comments:

Post a Comment