Credit in conflict areas is expensive because it involves risk. But the government can rediscover its subsidies set up and invest a bit of it in offering credit guarantees for making banks comfortable in altering a stunted growth

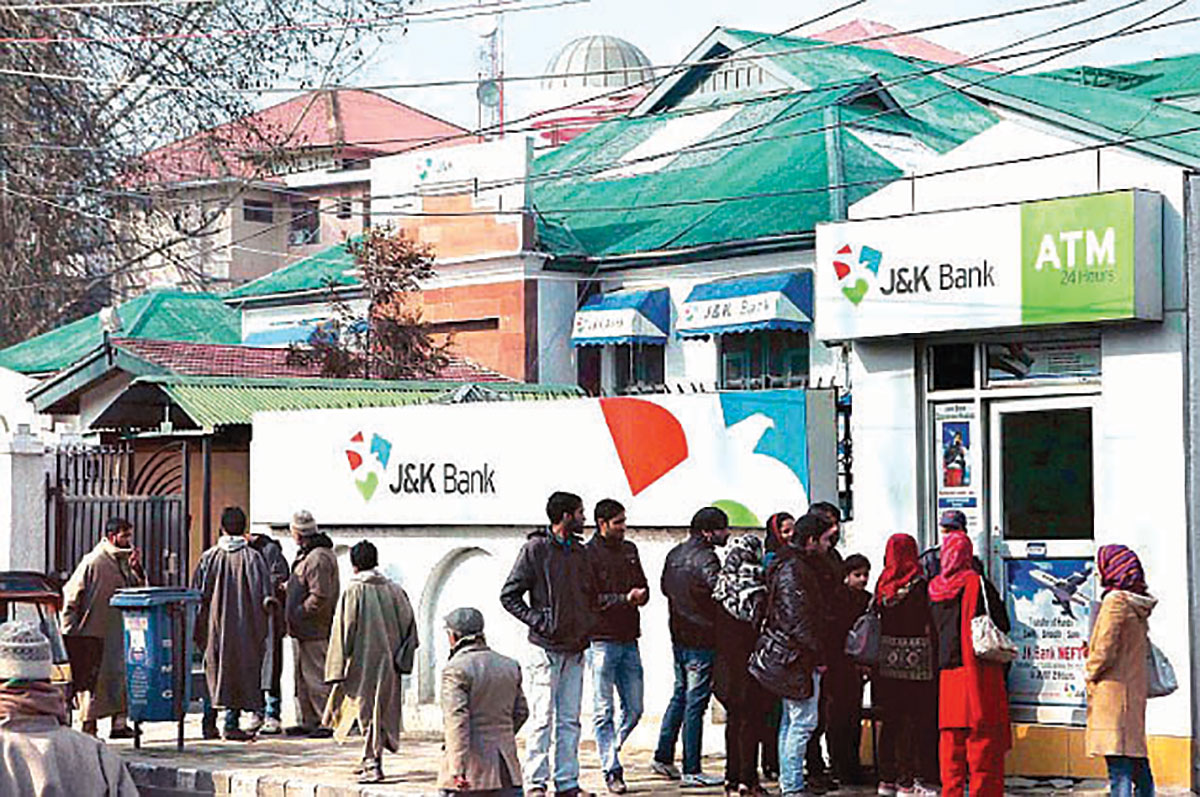

Imagine a customer sitting in front of a credit manager in any of the banks in J&K and asking for a loan. The standard first response of the manager would be; “can you provide guarantee of a government employer?” This typical sample conversation explains the predicaments of banks operating in J&K, the hassles faced by customers and implications on credit pricing.

Banks primarily deal with money and earn their profits by lending money against a cost. Lending in a conflict area like J&K is a risky business because uncertainty, lockdowns, curfews and sometimes weather stall normal business growth and impact the repayment capacities of the borrowers. That is why banks show reluctance to lending in conflict areas and resort to such mitigation measures which have no relation with the business plans of the customers. Seeking mortgages of disproportionate immoveable property to secure a loan is one such measure. For smaller loans, guarantees of government employees are asked for, as the government employees are supposed to have regular and assured income streams.

One more way of risk mitigation generally practised by the banks is to factor in risk premiums into the pricing of the loan. That makes credit much costlier for a businessman in J&K as compared to his counterparts elsewhere. As is evident, this creates a vicious circle of high-cost debt and lower margins for businesses in J&K and impairs their competitiveness and growth.

It has been generally seen that banks in J&K, apart from showing general reluctance to lending to businesses within the state resort to all the above measures to secure their loans. This does not just make loans costlier in terms of rates of interest but also adds opportunity costs to the operations of local businesses by making access to credit difficult.

As a result and on the other hand, while banks have expanded their operations in the state considerably over the last two decades, they usually engage in deposit-taking and pawning activities and shy away from lending to the extent possible. The new generation private sector banks, with their fast growing branch network in the recent years, have also not been able to make any considerable difference. These banks usually target High Net-worth Individuals (HNIs) for low-cost deposits and for third party product sales. The only innovation in lending they have so far introduced in J&K is lending against gold which is merely a pawning activity.

While it is a fact that the interest rates charged by the banks on the loans given locally are comparatively higher after factoring in the risk premiums, these are not the only costs businesses pay to get loans from financial institutions in J&K. There are other ‘sunk costs’ which businesses in J&K have to invariably incur. The reluctance of banks to lend to businesses generally, Greenfield businesses in particular, adds to cost of doing business in J&K. Even if a businessman is ready to pay any rate of interest to get a loan, the banks may not lend money to him adequately. This either results in under financing of projects and their subsequent sudden death or their sluggish growth.

The other factor that makes funds costlier for the business fraternity is the insistence of banks on mortgage of immoveable assets as a collateral security. A collateral security is an asset which the borrower already owns and which is not created out of loan the bank intends to give.

The third important factor which reduces growth and expansion of business is the under leveraging of fixed assets and landholdings. This also is a direct consequence of J&K being a conflict region. Banks usually insist on taking mortgages two to three times the value of the loan they extend. This highly impacts the fungibility of the immoveable assets of the business and impairs their capability to leverage these assets to secure more funds.

All these measures used as risk-mitigation means tools by the banks make credit expensive in the state. J&K is a unique state where economic activity is driven more by government spending than by private enterprise. This is becase private enterprise is too small and is unable to grow farther. Any downward trend in government spending and investments in public infrastructure invariably result in economic slowdown in the state. This is a situation which is neither desirable nor sustainable.

Businesses and private enterprises have to necessarily grow in the state for a sustainable economic turnaround. But the growth in business is not possible in the face of credit scarcity. The banks, by making credit scarce and expensive, are infact hampering the growth. Risk mitigation in a conflict region has to be a specialised function. Conflict zones, across the world, provide ample opportunities to financial institutions, to redesign their products and re-orient their risk mitigation processes.

Use of credit guarantee cover provided by central government agencies like Credit Guarantee Trust Fund for Micro and Small Enterprises (CGTMSE) for loans upto Rs100 lakhs is one such option. It does with the requirement of taking mortgages as collateral security. Upto a certain limit, the premium to be paid to CGTMSE for their guarantee cover is borne by the banks themselves.

The state government has usually been providing capital and interest subsidies to businesses availing credit from banks. As has been seen over the years, the impact of such subsidies has little trickle-down effect. The state government, instead of providing cash subsidies to businesses, should think of providing guarantee cover to business loans and set aside a corpus for the same. This can increase its outreach by more than 10 times as the actual cash outgo will be much less as compared to that in credit subsidies.

On the other hand, the banks will also be more comfortable to lending to business covered by a state government guarantee. This will not only make credit accessible to a much larger number of businesses but will also make it more affordable and less costly.

from Kashmir Life https://ift.tt/2kVOg68

via IFTTThttps://kashmirlife.net

No comments:

Post a Comment